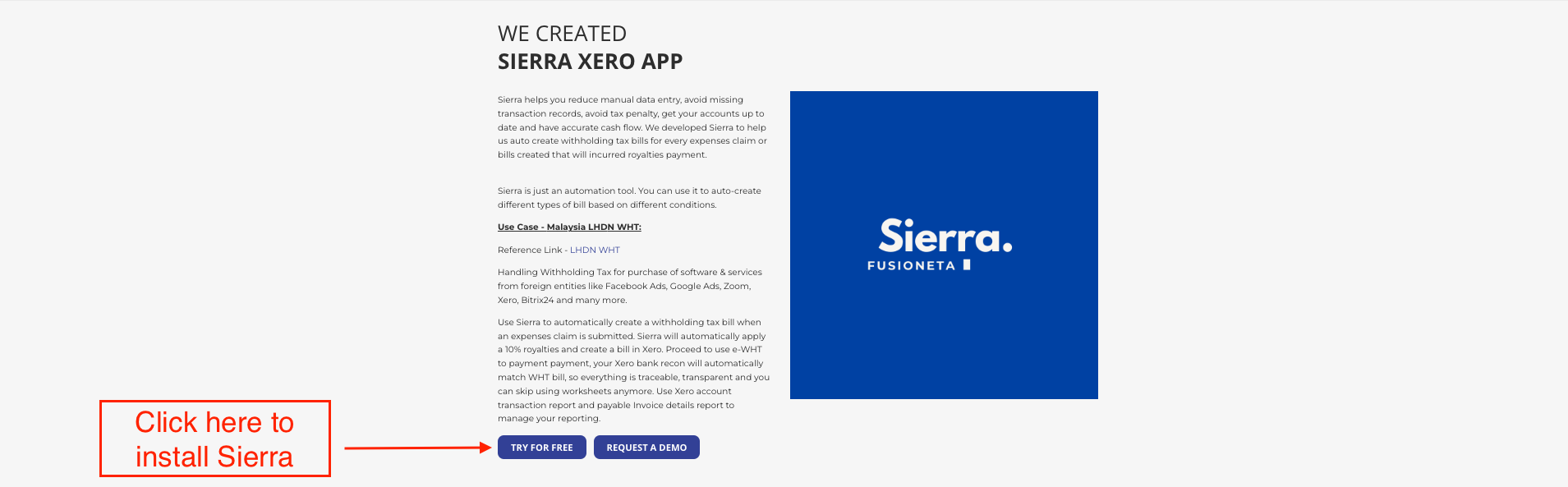

We created

SIERRA Xero app

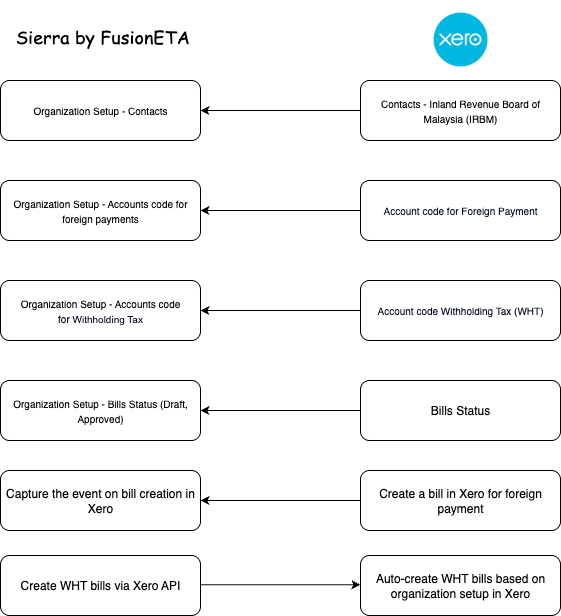

Sierra is just an automation tool. You can use it to auto-create different types of bill based on different conditions.

Use Case - Malaysia LHDN WHT:

Reference Link - LHDN WHT

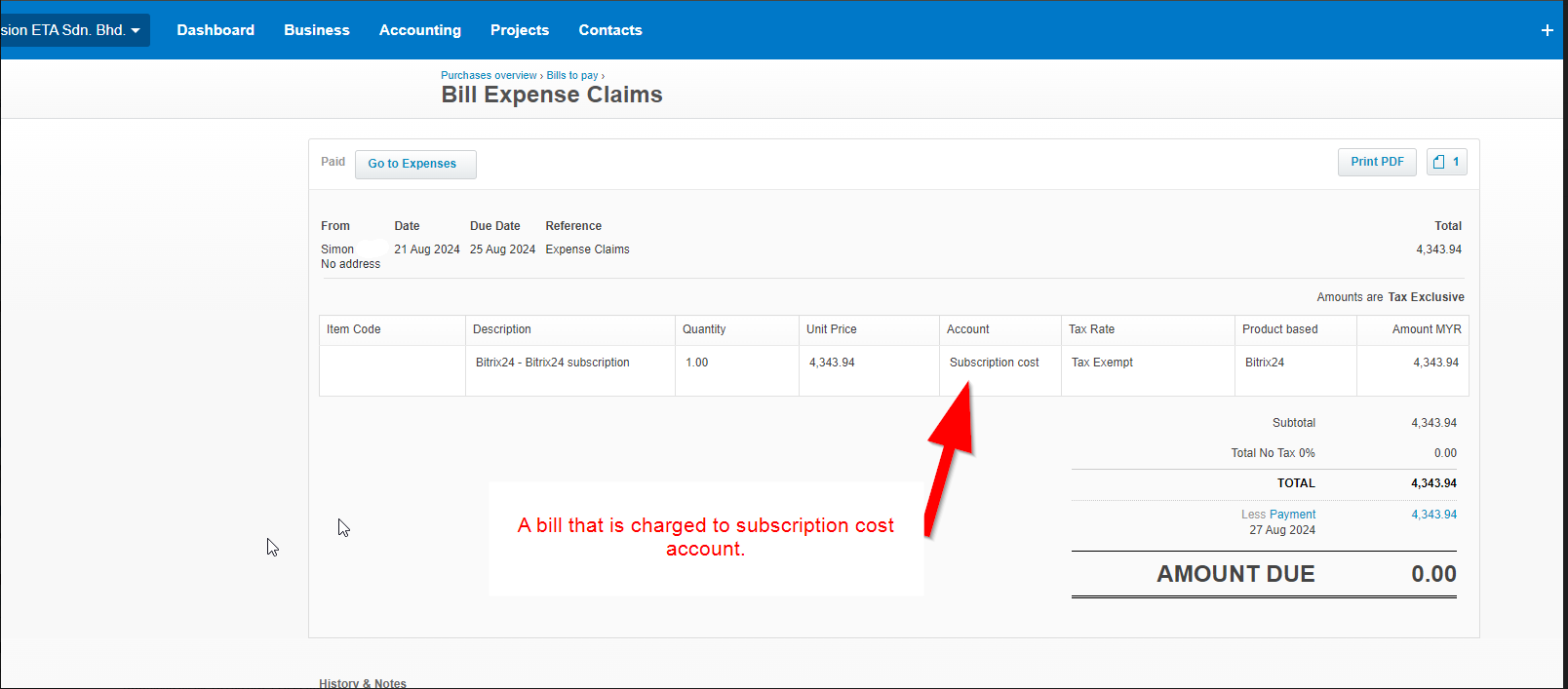

Handling Withholding Tax for purchase of software & services from foreign entities like Facebook Ads, Google Ads, Zoom, Xero, Bitrix24 and many more.

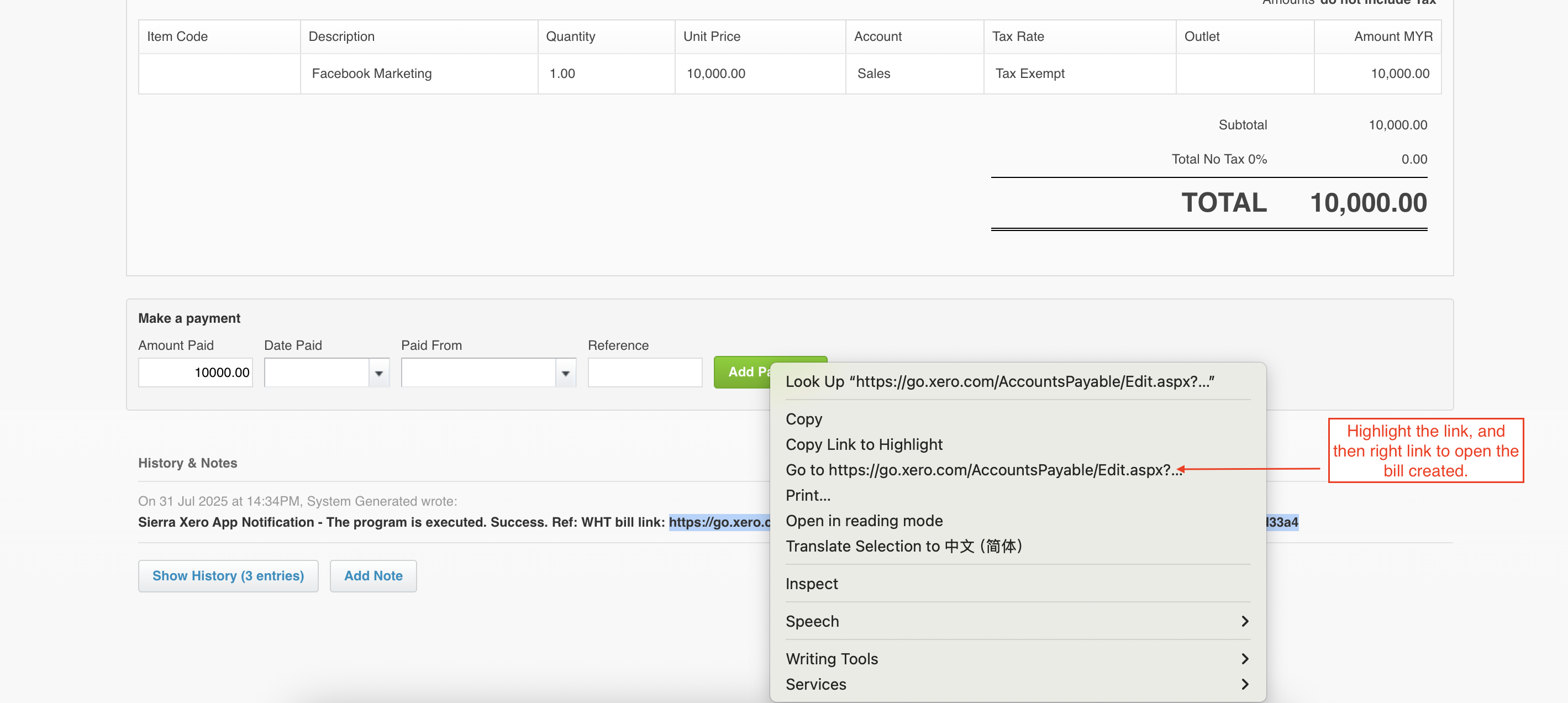

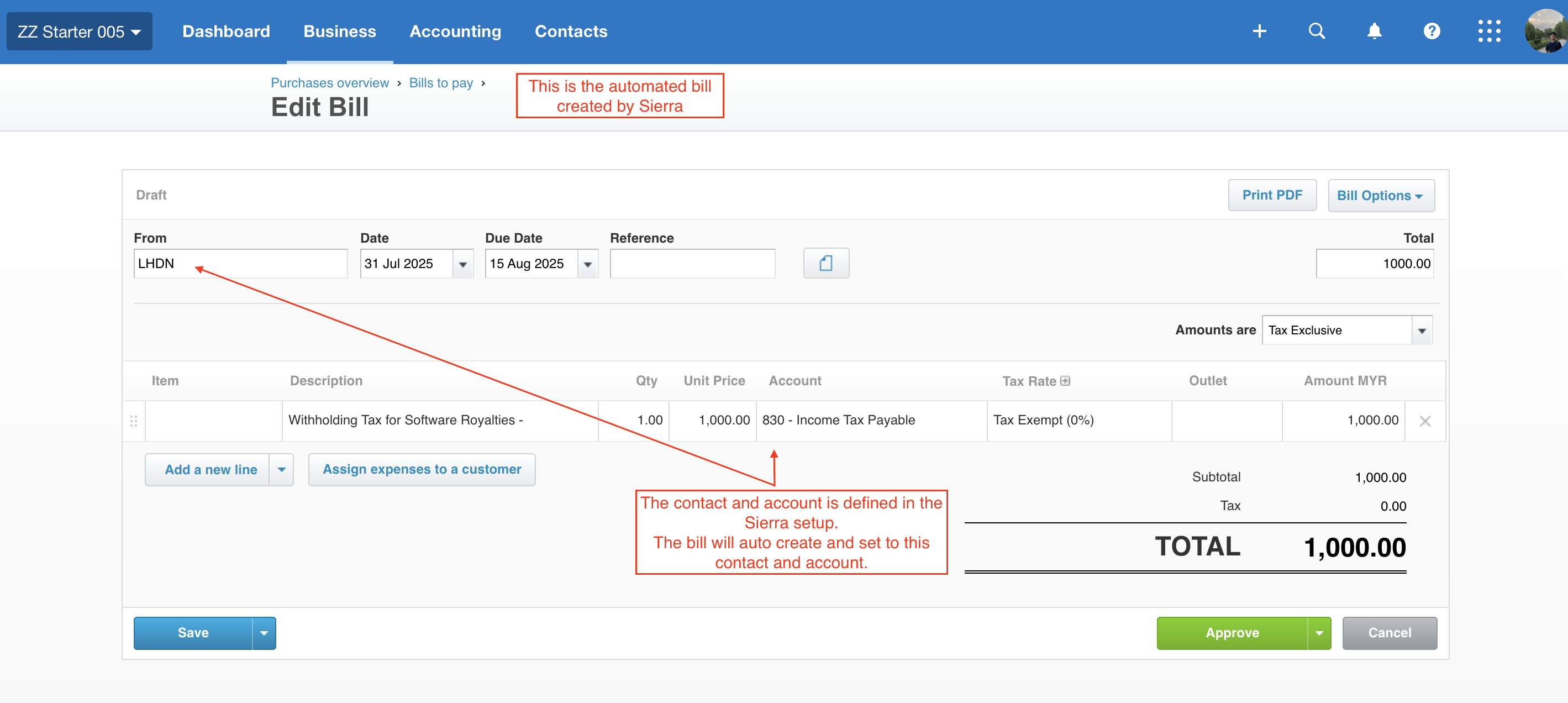

Use Sierra to automatically create a withholding tax bill when an expenses claim is submitted. Sierra will automatically apply a 10% royalties and create a bill in Xero. Proceed to use e-WHT to payment payment, your Xero bank recon will automatically match WHT bill, so everything is traceable, transparent and you can skip using worksheets anymore. Use Xero account transaction report and payable Invoice details report to manage your reporting.

Using Sierra to handle withholding tax (WHT)

If you have many recurring or one time payment to foreign entities that incurr withholding tax, managing withholding tax payments to LHDN is important to ensure compliance, avoid late penalty and ease of audit & tax process. Example of transaction that incurred withholding tax are subscription to Zoom, Facebook Ads, Google Ads, Xero, Bitrix24, GCP, DigitalOcean and many more.

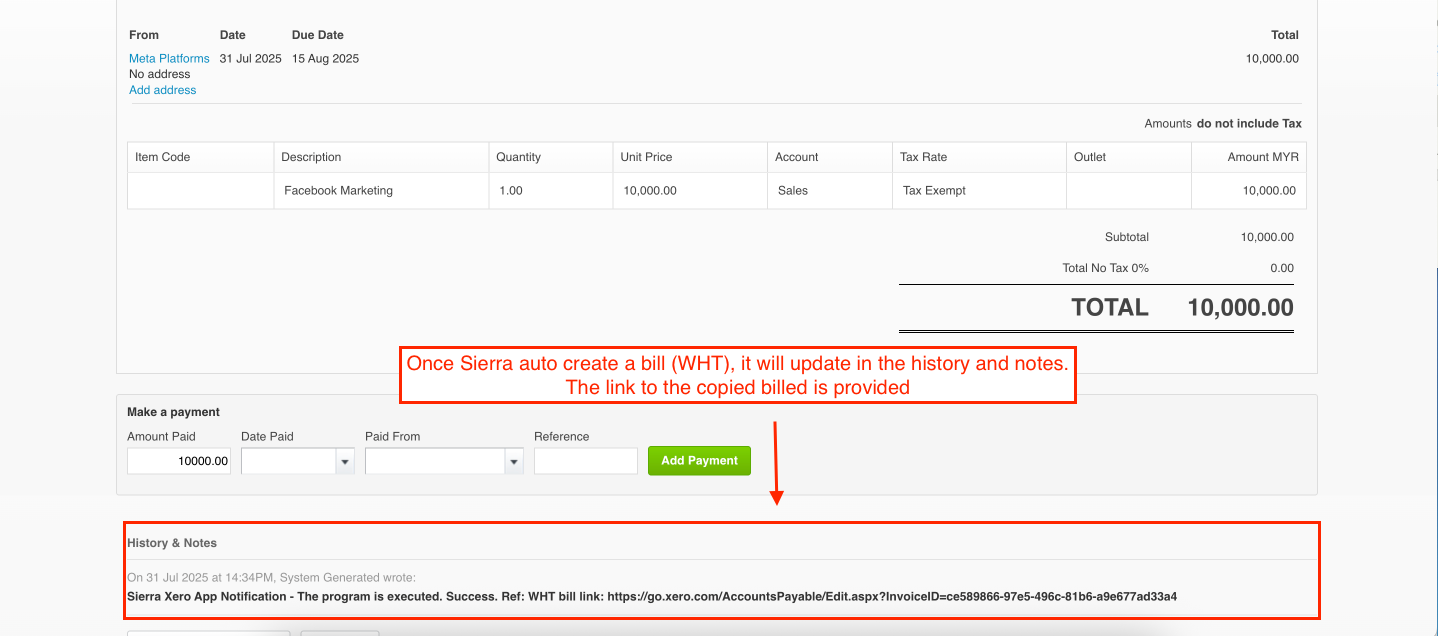

Our approach is designed to ease reconciliation and to ensure every payment made via e-WHT automatically reconciled to the WHT bill that was automatically created by Sierra.

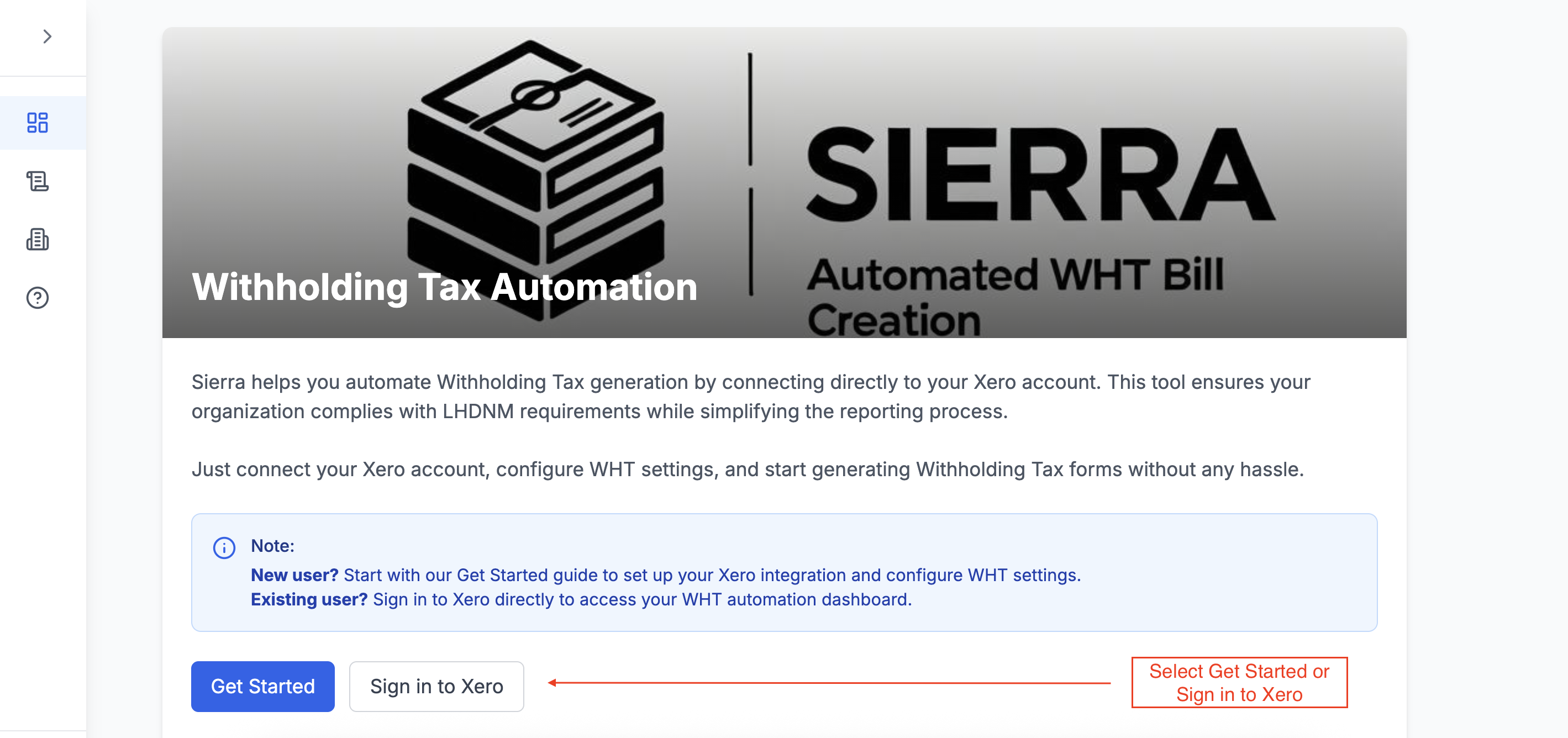

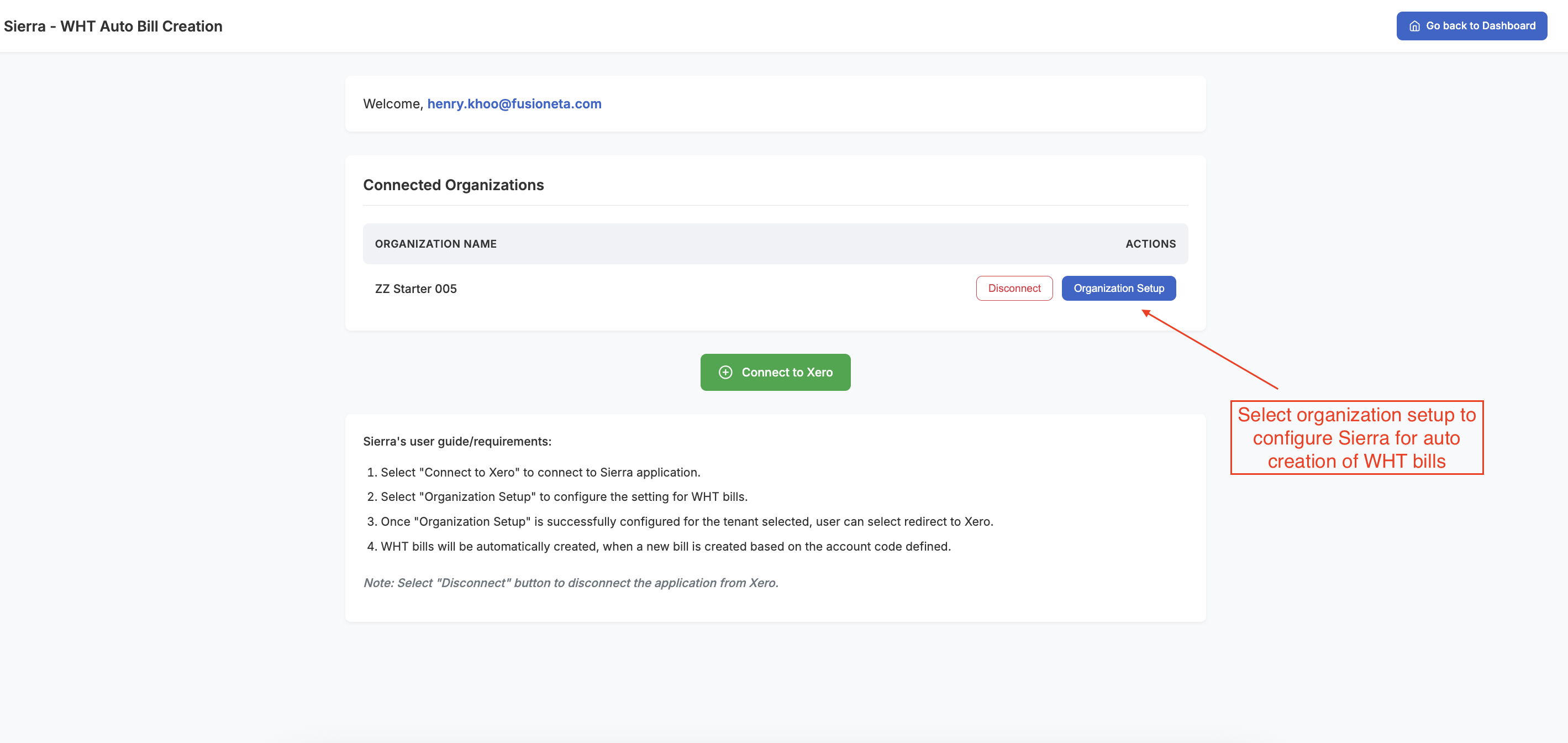

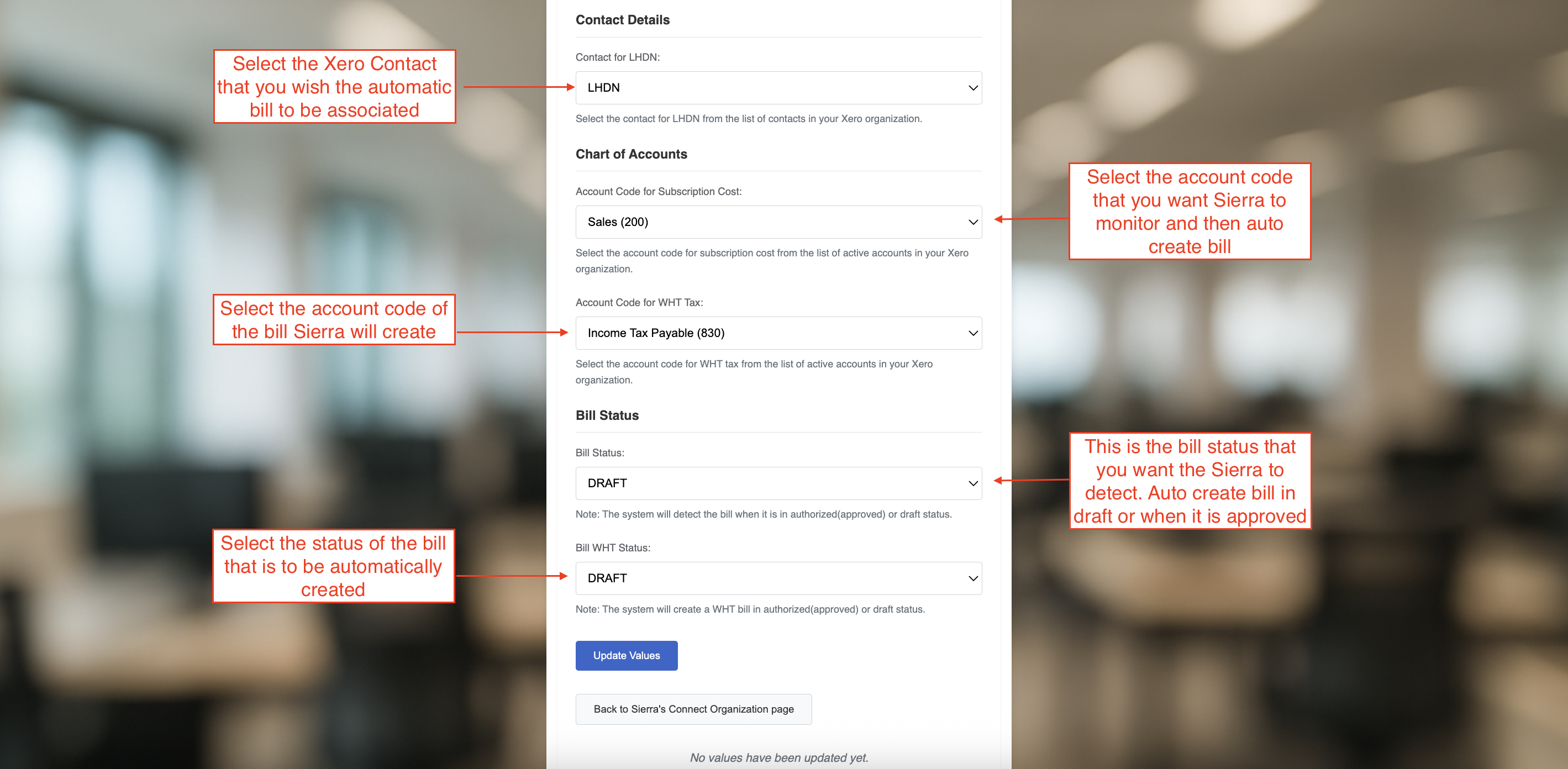

step 1 - Install and setup

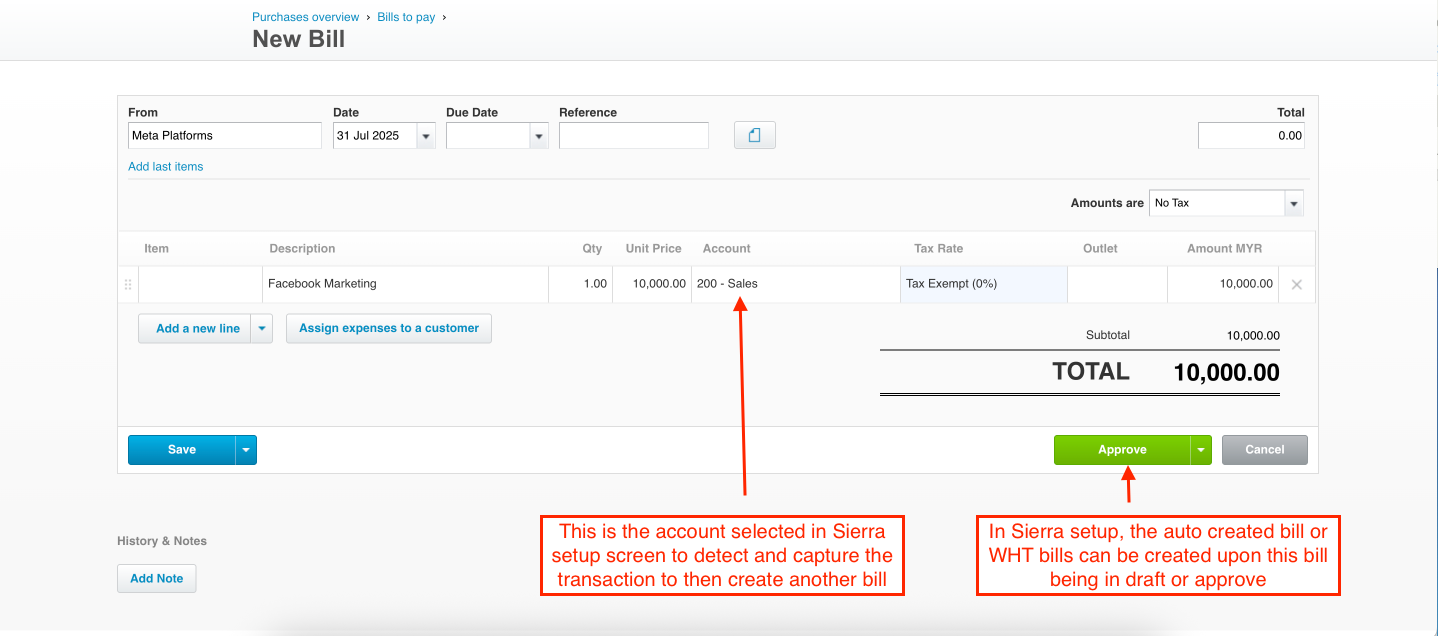

step 2 - create bills

1. How do I connect to Sierra?

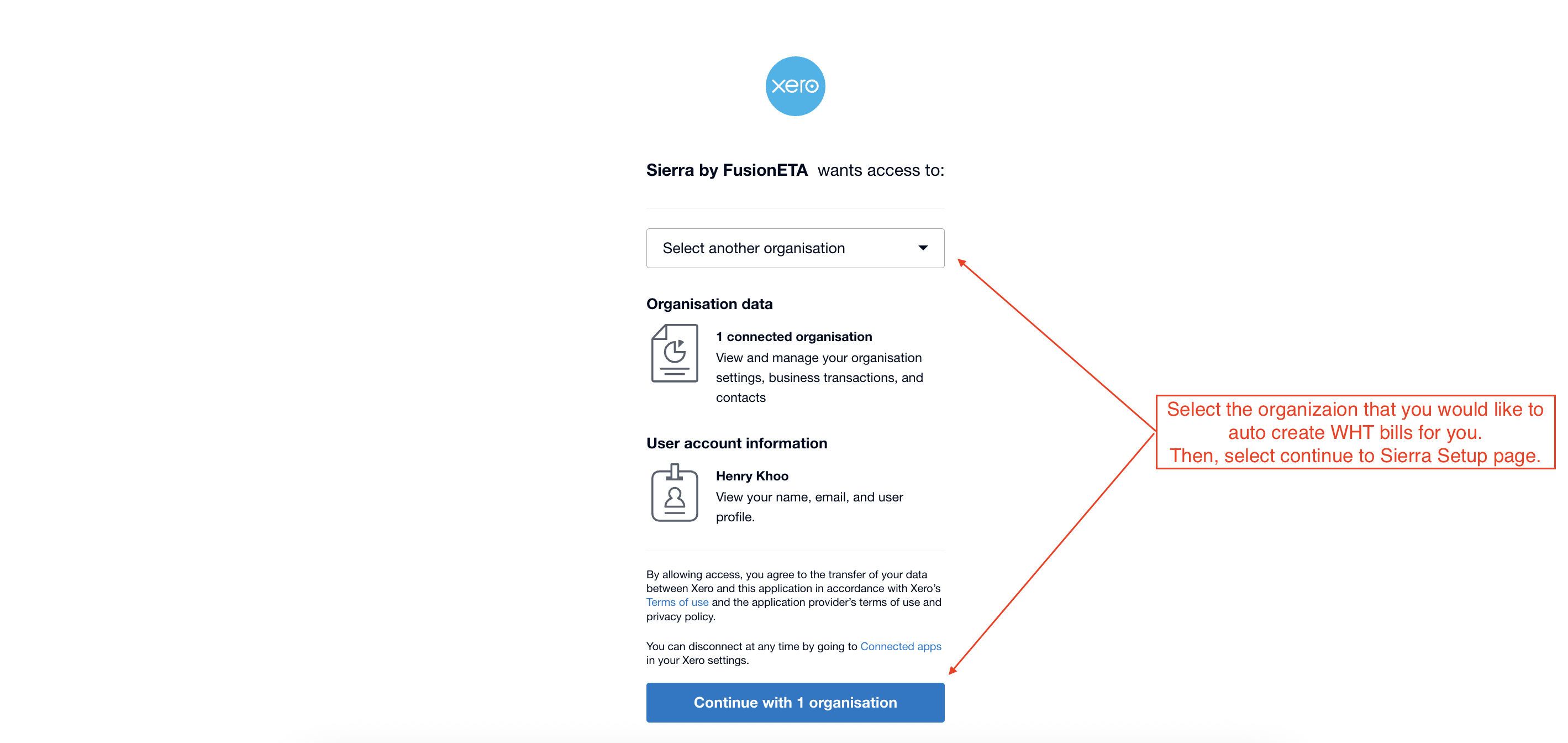

You can log-in using your Xero account on Sierra's platform or through the Xero App Marketplace to connect Sierra with your accounting system.

2. Can I see the data of several Xero organisations in Sierra?

Yes, you can switch from one Xero organization to another within your Sierra account to manage withholding tax automation across multiple entities.

3. Do I need to record transactions in both systems?

Sierra automatically creates WHT bills in Xero when expense claims are submitted, eliminating the need for duplicate data entry.

4. When and how does data sync occur? Is it manual, automatic, on login, in real-time?

Sierra automatically monitors your Xero expense claims in real-time. When an expense claim for foreign services is submitted, Sierra immediately creates the corresponding WHT bill in Xero.

5. Can Sierra handle different types of withholding tax scenarios?

Yes, Sierra is designed to handle various foreign service payments that incur withholding tax, including software subscriptions, advertising spend, cloud services, and other digital services from foreign entities.

6. Can Sierra support different withholding tax rates?

Currently, Sierra applies the standard 10% royalties rate for Malaysian LHDN WHT requirements. For different rates or custom configuration, contact our support team for more enquiries and customization.

7. Is there a limitation on the number of users per account?

No, you can have multiple users accessing Sierra, as long as all users have appropriate access to the related Xero account for proper integration functionality.

8. How do I disconnect from Sierra?

Access your Sierra account settings and look for the integration section to disconnect from Xero. You may also need to revoke access from within your Xero account under Settings > Connected Apps.

9. What doesn't Sierra's integration do?

Sierra is specifically an automation tool for creating WHT bills. It doesn't handle general accounting functions, comprehensive expense management, or replace your primary bookkeeping workflow - it focuses solely on withholding tax compliance automation.

10. How do I reconcile WHT bills created by Sierra in Xero?

After paying through LHDN MyTax e-WHT portal, Xero's auto-reconciliation will automatically match your e-WHT payment to the Sierra-created WHT bill, providing a clean audit trail without manual intervention.

.

.