Price

It's Free until 30 April 2024.

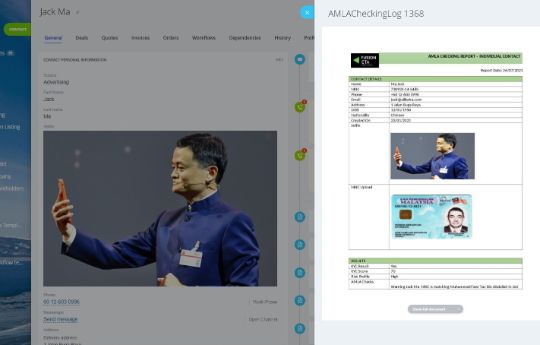

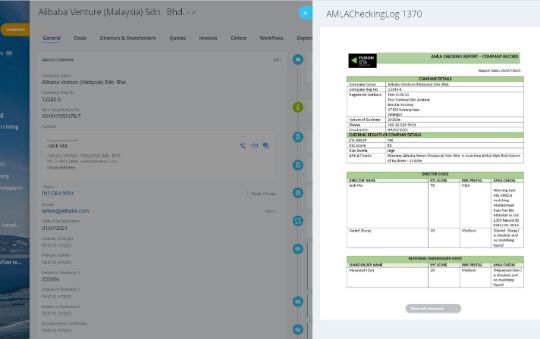

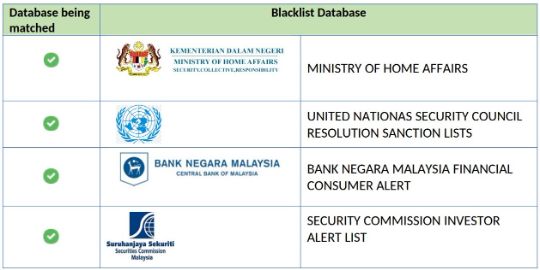

Input your client full name to check the name across UNSCR, MOHA, BNM, SC and Politically Linked Person (PEP) database. A report will be sent to you as evidence of you performing the checks.

It's Free until 30 April 2024.

You will get a pdf report based on the checking result

We cover UNSCR, MOHA, SC, BNM and PEP

For feedback, do drop use an email to amla@fusioneta.com