Industrial

photos

CP500

Alone

in the desert

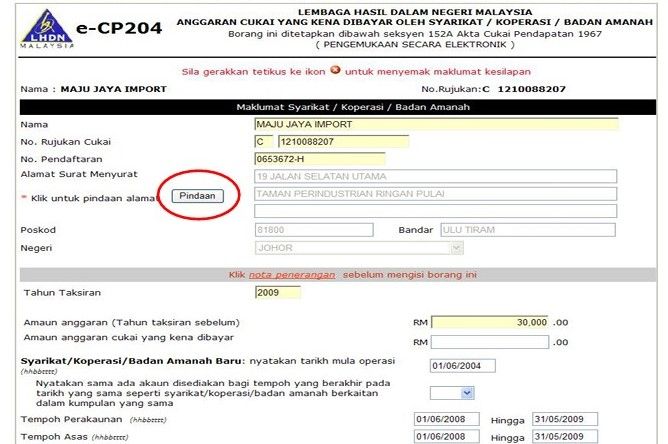

How to use Xero to handle LHDN CP500 or CP204

Xero can help you to make recurring bills, so you won’t get penalty for paying tax late! Either CP204 or CP500.

Xero has the features to track and pay bills on time. As we are aware that late payments for income tax may led to penalties.

By using Xero, you can set up the bills to pay for LHDN and see when the bills are due and when to pay.

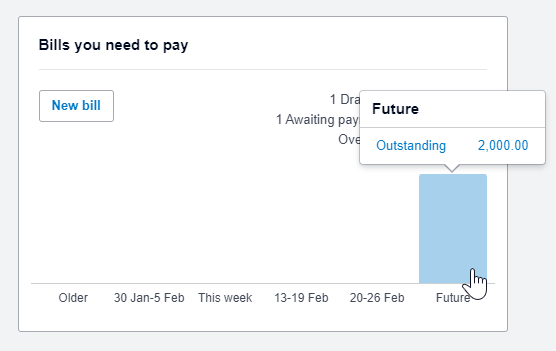

- Assuming your CP500 RM 12,000 and need to be pay instalment for 6 months. So, your monthly tax payment is RM 2000 for 6 months.

- From the Xero dashboard you can see the bills that you need to pay. You able to simply scan and make payment on time.

Picture on the right is the example: Your outstanding tax instalment that need to be pay is RM 2000, it will automatically appear when you set up the recurring bills.

Work process

Step by step to manage CP500

...

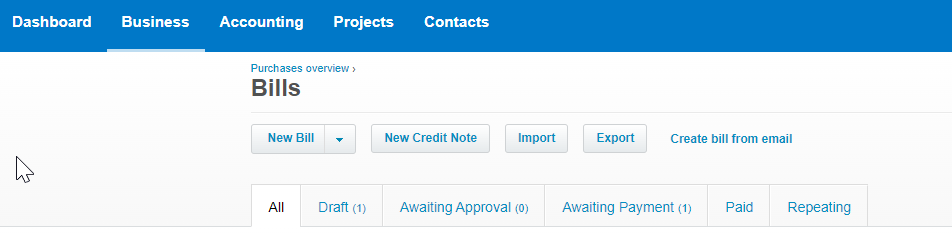

Step 1. Create New Repeating Bill

Click “Business” > “Bills to Pay” > “New Repeating Bill

Step 2. Edit Repeating Bill

When you received the CP500 from LHDN. Check when you should start to pay and the end date.

For example, you need to pay the tax instalment every 2 months. Starting from 1 Feb till 1 Dec 2022. Then your due date to pay the tax is 30 days of the current month. If you forgot to pay within the timeline there will be 10% penalties. So here in the Repeating Bill page you can set it up as below:

A) How frequent you want the bills to repeat? By monthly or every 2 months? This is based on the CP500 that you received.

B) Set the date when the bill needs to be pay

C) This is the due date from the date that you need to pay. Usually, you need to pay within the month.

D) End date for the tax instalment of CP500.

Step 3. Setup Frequency

Step 4. Approve the bill

Contact us

Product and Service Enquiry

No. 38, OFFIZO Suites, Jalan Radin Anum, Bandar Baru Sri Petaling, 57000 Kuala Lumpur, Wilayah Persekutuan Kuala Lumpur

.

.